Norway is just a rich, European Algeria with a big piggybank. That means it’s going to survive the transition adequately, but its economy is going to radically transform.

Norwegian cabinet minister Ola Borten Moe recently criticized plans by state-owned renewable-energy producer Statkraft to build 2 GW of green hydrogen in Norway by 2030. In a Facebook post, he expressed concerns about the amount of power needed to power 2 GW of electrolyzers, which he estimated would require 12-13% of Norway’s power, and that converting electricity to hydrogen and back again would result in 75% energy losses. He called the goal “light years away from being justifiable or sensible.”

However, Borten Moe’s statement came hours after two fellow cabinet ministers in the coalition government had taken German vice-chancellor Robert Habeck on a visit to a hydrogen factory, where they discussed plans to build a large-scale hydrogen pipeline between Norway and Germany by 2030. Borten Moe later stated that he had not intended to criticize government policy and that he agreed that hydrogen could make sense as long as it was utilizing surplus renewable energy.

This is an interesting chain of events and worth unpacking a little.

First, was Borton Moe correct? Yes, yes he was. According to data from end of 2020, the total installed capacity of the Norwegian power supply system was 37,732 MW, and normal annual production was 153.2 TWh. At 90% utilization, 2 GW of electrolyzers would require approximately 17.52 TWh of electricity per year or about 11.4%. At 100% utilization (unlikely), it would consume 20.74 GWh, or 13.5%. Borton Moe’s math is good.

As I pointed out in a report for northern African green hydrogen production last year, green hydrogen requires firmed electricity to achieve high utilization factors for electrolyzers. You can’t make cheap hydrogen with occasionally surplus electricity due to the capital costs of the electrolysis plant, and to be clear, a 2 GW plant is a large plant. And if hydrogen isn’t down near natural gas in terms of costs, no one is going to use it.

So, firmed electricity. In Norway that means business rates of $166 per MWh. Borton Moe was fairly accurate about the amount of energy wasted in manufacturing, compressing, distributing and then using hydrogen for electrical generation. Using his 75% waste number, that means that the wholesale price of electricity in Germany from this hydrogen deal would be around $664 per MWh, just from the cost of the electricity inputs.

If you don’t use firmed electricity, but run electrolyzers at 40% capacity factors, then you still have to make special deals for off-take and transmission with grid operators, as wind and hydro facilities aren’t onshore or next to one another, so getting electricity from both requires transmission infrastructure and the like. Assuming you can get electricity for half the price, the capex drives the hydrogen cost back up, as Lazard’s hydrogen LCOE material makes clear.

Prior to the energy crisis, Germany had among the lowest wholesale electricity prices in Europe, averaging under $50 per MWh, so Norwegian green hydrogen would be about 14 times more expensive. Even at the worst of the energy crisis, which is dwindling as I predicted it would back in September, Germany’s peak wholesale prices for electricity were only $469 per MWh for a single month, and on average were under $200.

Getting hydrogen from Norway for electricity in Germany would mean wholesale electricity rates three times higher than the average during the energy crisis. That’s not an economically viable energy policy.

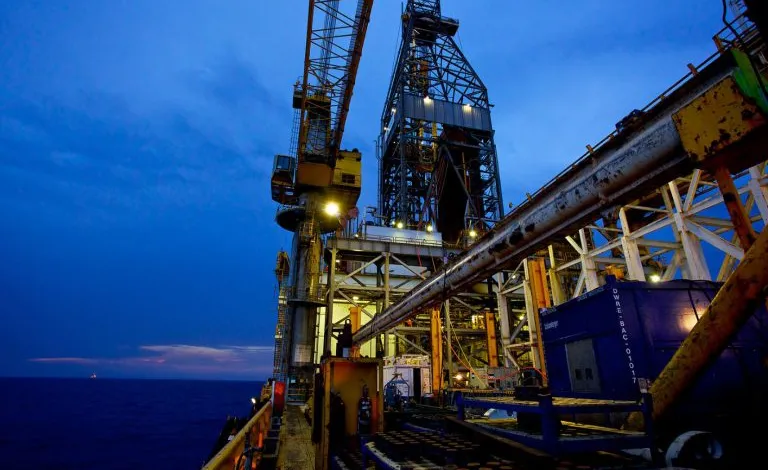

So why is Norway pushing this nonsense? In 2021, oil and gas made up 21% of Norway’s GDP and 51% of total exports. 21% means closer to 50% of secondary and tertiary GDP. Without oil and gas revenues, Norway would collapse in on itself.

It’s not like Norway didn’t see this coming. The Government Pension Fund of Norway, also known as the sovereign wealth fund, was established in 1990 to manage the country’s surplus oil and gas revenues. Initially, the fund was created to help ensure that future generations would benefit from Norway’s natural resource wealth. The fund’s assets have been invested primarily in equities and fixed-income securities, with the aim of achieving long-term returns to help fund the country’s public pension system. The fund has grown significantly over the years and is now one of the largest sovereign wealth funds in the world, with assets valued at over $1 trillion as of 2021.

But having been good ants and not grasshoppers like Albertans, Norway is still subject to short-term silliness. The current crop of politicians running things, with the exception of Borton Moe apparently, have their noses open with the hope that hydrogen will save their economy.

The oil and gas majors such as Norway’s Equinor see this most clearly. They are pushing a specific narrative hard, that we need to replace gases and liquids used for energy with gases or liquids that are green, and that hydrogen is the answer, whether used directly or made into synthetic fuels. Given the economics above, they know that if they can get governments to make this the transitionary strategy, then blue hydrogen will suddenly look cheap and be heavily used as another ‘bridge’ fuel as natural gas was claimed to be. If they don’t succeed in this, then all of their fossil fuel reserves are worth nothing, and so they will be worth nothing.

How big a deal is this? Norway has 51 trillion cubic feet (Tcf) of proven natural gas reserves as of January 1, 2022 and each Tcf was worth about $3 billion in 2018 in the cheapest natural gas markets in the world. That’s what’s at stake, and that’s why deeply irrational behaviors are emerging in oil and gas economies like Norway.

Of course, this is not a climate or energy solution at all. Starting with the energy part, it actually makes rejected energy worse. Sankey energy flow diagrams will include even more rejected energy if steam reformation of natural gas or coal gasification processes are used to extract hydrogen from those fossil fuels. And they’ll get even worse if hydrogen is made into synthetic fuels. All of that rejected energy comes from somewhere, and in the future it’s supposed to be green electricity. Throwing away not two-thirds of energy but five-sixths of green energy we don’t have is a remarkably bad idea.

On the climate side, steam reformation of hydrogen means upstream methane emissions during extraction, processing, distribution, and use, and methane is a potent greenhouse gas. Norway happens to be among the world’s best at preventing those leaks, so they might be able to square that circle, but the steam reformation process produces 8-10 tons of CO2 for each ton of hydrogen. That’s where carbon capture comes in, but that’s an energy intensive process as well, taking 15-25% of the energy of the process, and that CO2 is heavy and bulky. Cradle-to-grave capture, distribution and sequestration of CO2 is well over $100.

Oh, and that’s for the cheap version of carbon capture that only captures 85% of the CO2 emissions from steam reformation. If you want to capture 98%, you need to put another process in with more energy requirements and capital costs. Two-step carbon capture is what Carbon Engineering does with the natural gas it uses to power its foolish direct air capture process, which as I pointed out a few years ago, means that a third of all the CO2 its process delivers is from burning natural gas, not capturing it from the air.

So blue hydrogen isn’t a climate solution. And it will still be a lot more expensive than natural gas per unit of energy. I worked out for the section of the report on Algeria, a major gas exporting economy, that blue hydrogen would be five times more expensive. That’s energy crisis prices for natural gas, and that was completely unsustainable. Blue hydrogen is not an energy solution for Germany either.

Norway is just a rich, European Algeria with a big piggybank. That means it’s going to survive the transition adequately, but its economy is going to radically transform. And that transformation is looming, as I pointed out with the expectation of peak oil demand in the last half of this decade, and peak natural gas demand likely by 2035. And that means very odd behaviors like Borton Moe being publicly embarrassed and humiliated by first telling the very obvious truth and then being forced to eat his words.

Source: Clean Technica

Comment here