As part of its efforts to ensure adequate crude oil supply to Nigerian refineries, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) said it called a meeting of all parties, where a sustainable template had been agreed with oil producers to supply local refineries crude feedstock adequately.

According to the commission in a statement on Thursday, the Federal Government and crude oil producers in the country have now committed to working towards a viable supply of crude oil to Nigeria’s refineries under a market-determined pricing system.

The NUPRC said this collaborative effort aimed to ensure that while the operators did business optimally, the refineries were not also starved of feedstock.

The pricing issue for local crude sold to refineries in Nigeria had remained a major problem, with Dangote Refinery recently accusing the International Oil Companies (IOCs) of having a mark-up price of as much as $6 over the normal rates.

Consequently, the industry regulator, NUPRC, directed oil refiners in the country to provide monthly price quote on crude supply to ensure a more seamless process.

The oil producers came under the umbrella of the Oil Producers Trade Section (OPTS) of the Lagos Chamber of Commerce and Industry (LCCI) to the meeting called by NUPRC.

They agreed to concede to a framework that would be mutually beneficial, to ensure that local refineries were not strangulated due to “off-the-curve” prices, the statement added.

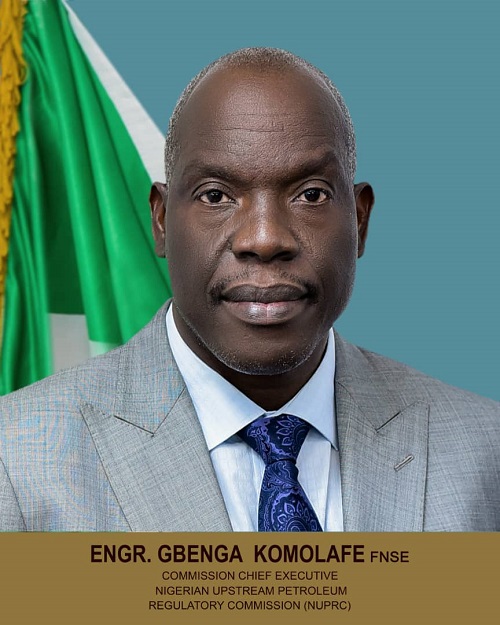

The focus of the meeting held at the instance of Chief Executive of the commission, Gbenga Komolafe, was on the status review of the framework for seamless operationalization of the domestic crude oil supply obligation template.

NUPRC said it was part of efforts to effectively implement key sections of the Petroleum Industry Act (PIA), especially the issue of pricing and crude supply to the domestic refineries.

At the event, Komolafe said President Bola Tinubu was fully committed to providing a level playing field for producers and refiners to do business in the industry.

He emphasised the need for a rule of engagement to ensure that the pricing model from the oil producers did not hinder the domestic refineries.

Komolafe directed producers and refiners to provide NUPRC with cargo price quotes on crude supply and delivery for effective monitoring and regulation of transactions among parties.

“We need to have the price quotes monthly,” the statement quoted Komolafe as directing.

The NUPRC chief executive pointed out the convergence between the Domestic Crude Supply Obligation (DCSO) and the country’s energy security, indicating that his team was re-engineering its regulatory processes to address the challenges.

He added, “We allow all our processes to be transparent. While the federal government targets the implementation of the regulation, all parties must submit to the rules of engagement as a guide for operation.”

He said the regulator was committed to driving the willing buyer/willing seller provision.

Komolafe stated, “We have to discuss pricing, especially, as parties have committed to respecting their domestic crude oil obligation. As the regulator, we don’t want the upstream sector to be operated sub-optimally through cost under-recovery.

“So, the regulator is very alive to that. In crude pricing, we will never allow price strangulation to ‘disincentivise’ our domestic refining capacity optimisation. The regulator does not support cost under-recovery in the upstream sector.

“We will continue to work to ensure that crude supply profiteering, as a negative factor that can strangulate our domestic refining capacity optimisation, is disallowed.”

He emphasised the imperative for appropriate pricing to drive willing buyer willing seller referencing guided Fiscal Oil Price (FOP) published by the commission in line with the provisions of the PIA.

The NUPRC chief executive added, “The NUPRC is committed to attracting the needed investments to boost upstream development and optimisation of our hydrocarbon resources, just as we want sustainability of domestic energy supply in the midstream and downstream sector.”

Meanwhile, Nigeria’s new Dangote mega-refinery lapped up ever more US crude, bringing the barrels thousands of miles across the Atlantic Ocean, Bloomberg reported yesterday.

Dangote bought more than 16 million barrels of West Texas Intermediate (WTI) crude oil so far this year, data compiled by Bloomberg showed. In August and September, the proportion it will take from the US — as opposed to Nigerian barrels — may be set to rise, based on tenders for new supply seen by Bloomberg.

For Nigeria and Dangote, the use of US crude likely reflects where there are spare barrels available to buy in the world and the most competitive price. The refinery has been billed as a way of helping Nigeria wean itself off foreign fuel supplies.

The refinery near Lagos mostly runs on local crude supplies that can reach the plant from offshore terminals in as little as a couple of days.

It took in more than 41 million barrels of feedstock in the first half of the year as it completed test runs and gradually increased processing rates, tanker-tracking data showed. Of that, about a quarter has been American supply, the report added.

Inflows of American feedstock could be about to increase significantly. In the past week, Dangote purchased five million barrels of WTI Midland for delivery next month and in September.

The company also started a tender process in which it was looking to buy a further six million barrels of American crude for September.

According to a Bloomberg report, Nigeria competes with rival suppliers, like the North Sea, Mediterranean and North Africa, for crude sales in Europe and Asia.

Comment here